This post is a slight-break from global health.

But it is still centered on entrepreneurship… In my past week, I have come across one of my favourite kinds of entrepreneur: the hard-working baker.

Waking up at the crack of dawn each morning to bake delicious cakes, pastries and cupcakes for dozens, if not hundreds of strangers per day – and still have the grace to smile and chat to customers about their favourite flavours exemplify academically verified characteristics of entrepreneurship: perseverance, positive attitude, and constantly willing to adapt and innovate to customer tastes (no pun intended!).

Bakers of the world – I commend you!! (and I thank you for your kindness and the ability for you to improve any down-trodden, tough working day).

Vanilla Almond / Maple Frosting

I would like to highlight 4 independent baker/entrepreneurs in London and invite anyone for a try. The best part of asking bakers why they do what they do is because these 4 all gave the same answer: “Because I love it”.

Rebecca @ Daisy cakes in Cambridge Market http://daisycakesincambridge.blogspot.com/

The red-velvet aussie man (as I refer to him) @ http://www.kookybakes.com/blog

I can’t imagine having another job lady (as I refer to her) @ http://mysweettoothfactory.blogspot.com/

Classic Bea’s of Bloomsbury (this is a sit-down store) @ http://www.beasofbloomsbury.com/

And for the “Red Velvet” one that started my love affair with cupcakes (this is +1 additional recommendation, but haven’t talked to the owners/bakers yet…) @ http://hummingbirdbakery.com/

Filed under: Uncategorized | Leave a Comment

Twitter @ AIPrize

Dear All –

We are proud to launch the new African Innovation Prize website @ AIPrize.wordpress.com

Please view all future updates at the new website and twitter feed!

Twitter @ AIPrize

A year has past since my KIST visit in 2009… It’s been a great year setting up AIP at KIST – Awards Ceremony on September 8, 2010 announced both the Phase I and Phase II winners. Congratulations you brilliant KIST students!

Filed under: Uncategorized | Leave a Comment

The African Innovation Prize is pleased to announce the judges’ decision for Kigali Institute of Science and Technology Business Challenge winners – awards for best business idea under 250 words.

African Innovation Prize (AIP) is a business plan competition run for its inaugural year at KIST, Kigali. The aim is to inspire student entrepreneurship and provide seed funding for new potential businesses started by students. We would like to thank all the KIST students who submitted entries in Phase I. 33 entries were received and these are the top 3 :

Project of implementation of composting dry toilet for Ecological waste management in RWANDA

Bertin HARERIMANA

Jean Baptiste DUSHIMIYIMANA

Rwanda is a country of 10 millions peoples, where more than 85% of population are farmers having a serious problem of fertilizers leading to food shortage.

Human excreta(feces and urine) is fertilizing potential which is less exploited because only 5% of this great fertilizer is collected, treated and utilized as dry or liquid fertilizer for soil improvement in agricultural area, for biogas and the rest is infiltrating in the soil or stored in the soil without being utilized.

Our project is to provide fertilizers from human excreta, by constructing dry toilet for Rwandan Population in urban and rural areas at low cost, on-site treatment, collection of treated human excreta and sell them to the agricultural area as fertilizers.

Also this project will permit us:

To prevent pollution and diseases caused by human excreta.

To manage human excreta as resource rather than as a waste product.

Recover and recycle water and nutrients.

To reduce the use of chemical fertilizers which are among water pollutant.

This project will contribute to sustainable development of our country by promoting agricultural (providing fertilizers to farmers) and by keeping stable our environment (management of waste).

A POLYMER RECYCLING PLANT

TURAMBE TWIZERE

In Rwanda most polymeric materials are thrown away as waste yet they can be recycled in to a variety of products needed at the market. There is an opportunity because recycling is still at its infancy in Rwanda where by only two plants are recycling high density polyethylene (HDPE) and low density polyethylene (LDPE) whereas other polymer type materials like polyethylene terephthalate (PET) which is common is not being recycled at the moment. The idea is to expand and develop recycling of polymers where by PET, polypropylene (PP) etc will be involved. It can also be noted that the technology of recycling polymers is being applied elsewhere in the world and it is effective therefore it is a matter of importing or applying it in Rwanda.

The business would be of great advantage in terms of environmental protection, conservation of resources and reduction of need for new landfills.

Initially it would be focused on the recycling of polyethylene terephthalate (PET) bottles whereby there are many of these in Rwanda and can be recycled in to a number of products like packaging materials, polyester fibers then used to make clothing, carpets, curtains, filling fiber etc. The plant can later progress to recycle other materials like polypropylene (pp) which also exist in large amount of the polymeric waste in the country.

DRYING OF FOOD AGRICULTURAL PRODUCTS

Patrice HABINSHUTI

In Rwanda, food agricultural products from farmers are exposed to huge losses due to unavailability of preservation methods. However, drying can be a real solution to this problem. It is also a huge spectacular business in our country where above 90% of the total population lives on agriculture.

GENERAL IMPORTANCE

-Drying helps is a method of food preservation helps to keep the food produced in abundance season, thus making provision for starvation period

-Drying is the base of new food formulation with an added-value.

-Drying of agricultural products mainly fruits and vegetables increase the level of exports.

DRYING, A MONEY-MAKING BUSINESS

*Exportation of dried food products:

-Naturally dried food products are preferred by people in developed countries. They are natural and rich in nutrients. No chemicals added. So, they are sold at high price.

-Africans living in developed countries are pleased with enjoying their traditional foods. They are able to pay much money for our products on their market.

*New Value-added food products:

-Drying helps to formulate new products with a long shelf-life that are marketable at high price

*Preservation of foods

-While providing foods during off-seasons, more money is earned.

WHAT IS REQUIRED?

-Operating site with a house

-Dryers and other equipments (Not Expensive)

CONCLUSION

Drying is still an unknown business in Rwanda. However, it can lead to our country rural development valorizing farmers’ production and helping the country to earn money from agricultural products.

Filed under: Uncategorized | Leave a Comment

Exactly around a year ago, this blog was started with the Idea of “What If” – What if there was a risk capital oriented social venture fund for global health projects? What about a Gates Ventures fund? Interesting idea? Better follow-up in continuing the conversation.

And doing even better, thinking further and putting ideas into action… In March 2010, an OpEd was published in the Financial Times by Alex Friedman, the former CFO of the Gates Foundation. Text included here in full below. Have fun reading!

How banks can help the world’s poor

By Alexander Friedman

Published: March 7 2010 19:53 | Last updated: March 7 2010 19:53

These days, it has become something of a trend to demonise capitalists and praise philanthropists. But if we are to make true progress in tackling our most pressing social problems and live up to our moral obligation to help those in extreme poverty, these two seemingly polarised groups need to come together in fundamentally new ways.

We need to stop separating investment decisions from philanthropic giving; the building and giving away of wealth should not be seen as disparate sets of skills. The world’s problems cannot be solved either by unfettered markets or by limited pools of philanthropic dollars.

Foundations, banks and governments are missing important opportunities that could dramatically increase the flow of capital to the social sector. In the last decade, new ideas have started to emerge that blend principles of giving and investing and are sometimes described as “venture philanthropy”, “social impact investing” or “double bottom line” business. But, these innovations do not go far enough and the major players need to work together in a more co-ordinated fashion.

Some foundations have started down this path. The Bill and Melinda Gates Foundation recently committed about 1 per cent of its endowment, beyond its normal grant-making, to support investment instruments such as bond guarantees, securitisation of donor aid flows and equity funds in the developing world. The Rockefeller Foundation helped launch a Global Impact Investor Network to mobilise new sources of investment for socially -oriented businesses. Meanwhile, financial institutions are likewise evolving: Goldman Sachs launched its “10,000 Women” initiative to encourage women entrepreneurs around the world; JPMorgan created a social sector finance group to bring financial skills and funding to non-profit organisations; and microfinance has become a mainstream business. On a macro level, the Obama administration recently created the Office of Social Innovation to work with the non-profit sector to tackle social problems. But all this is not enough.

At a broad level, four steps are needed. First, foundations could carefully lend against a small portion of their assets not given away each year. US foundations have about $600bn (€440bn, £398bn) in assets and make grants of about 5 per cent annually, so $30bn flows to the neediest. If these same foundations used 1 per cent of their balance sheet assets to support “deals” for the poor, this would direct an additional $6bn in resources annually to their core social mission. If this capital induced the levels of funding from banks and investors that it should, it would be possible to increase the flow of philanthropic dollars to the social sector by at least $30bn per year. This kind of leverage is achievable. A 1 per cent balance sheet initiative could double the amount of annual philanthropy.

Second, through their private client and wealth management businesses, financial institutions have a unique opportunity to work with foundations to syndicate grant-making opportunities. There is a laudable trend under way in which a whole new class of the working rich wants to be philanthropic. But, rather than set up their own foundations, they could identify the causes that matter to them and be offered a simple way to co-invest with the best foundations, which desperately need more funding partners.

Third, banks could develop a wider range of social sector finance products – expanding on their current, limited efforts in community lending, which are largely driven by the US Community Reinvestment Act. They could work with philanthropists and investors to structure deals that serve the poor, and begin to market and place these types of investments with private and institutional clients. Banks could also use a tiny portion of their balance sheet to participate in these deals, which have produced attractive returns during this latest period of market upheaval.

Finally, governments have the ability to bring about a revolution in giving and investing to rival the advent of philanthropy. Governments could provide tax incentives for high quality social impact investments both nationally and internationally, inducing active and liquid capital markets for these types of investments similar to the markets for municipal bonds or new market tax credits in the US.

The financial crisis has profoundly affected the world’s wealthiest nations, but it has been far worse for the world’s poor. Banks may have played a central role in causing this suffering, but they can also help lead the way out.

Now is the time for the financial and social sectors to change philanthropy, together.

The writer stepped down last week as chief financial officer of the Bill & Melinda Gates Foundation. He is a former investment banker at Lazard

Filed under: Uncategorized | 1 Comment

Wanted to follow up on this thread from Summer 2009. The African Innovation Prize has officially launched at Kigali Institute of Science and Technology (KIST). It is no longer a “concept”, AIP has become reality! We are running a business plan competition (modelled after the great ones MIT 100k Challenge and Cambridge University Entrepreneurs and Enterprize Canada).

AIP will run in two phases. Phase I will award prizes for best “business idea” under 250 words and Phase II will award seed funding for best “business plan”. We are now half-way through the open submission period March 1-31, 2010 which we are taking applications for Phase I. It’s exciting to see the submissions come through!

AIP Mission: to be an enabler of global entrepreneurship by encouraging university students to commercialize ideas and innovations

How: by creating a business plan competition for Rwandan University students to access seed funding and business mentorship

Values: integrity, passion, perserverance, creativity

Contact us: africaninnovationprize@googlemail.com

Filed under: Uncategorized | 2 Comments

Public global health lecture with Dr. Tachi Yamada (Gates Foundation) and Dr. Chris Elias (CEO PATH): Summary of key thoughts and themes –

The conversation started with a comparison between India and its neighbour, Bangladesh on maternal and child mortality rates:

| India | Bangladesh | |

| Baby deaths | 90/1000 | 60/1000 |

| Maternal deaths | 500/1000 | 350/1000 |

Bangladesh is not as wealthy as its neighbour, has less employed doctors per capita and has less government spending on healthcare both in absolute terms and per capita, but it has BETTER health outcome statistics. How? Why?

Answer: Healthcare is not only about dollars spent, but also about INNOVATION: technology uptake and introduction

Bangladesh has adopted an army of civil service organizations (think Yunus and Grameen bank who pioneered microfinancing, BRAC) and NGOs. They are allowed to implement innovative way of helping the poor and allowed to thrive under strong political will.

India has been slower in embracing these civil service organizations and has high political turnover. However, new business models have thrived to serve the base of its pyramid – such as Aravind Eye hospitals pioneering innovations in cataracts lenses. Lesson: Just because a country is poor, should not deprive them of technology.

Filed under: Uncategorized | Leave a Comment

I find this an interesting perspective on another way of “capturing value” from examination of a social enterprise business model. How can an investor compare “returns” from its donations? Perhaps BACO can help an charitable investor to decide which programs to invest in to have the highest impact… perhaps Impact value > financial value?

I am posting a summary of a BACO example (with full credit and reference to Acumen Fund Knowledge Centre article):

Objective: to quantify an investment’s social impact and compare it to the universe of existing charitable options for that explicit social issue. BACO is driven by financial leverage, enterprise efficiencies and technology leverage.

Question: for each dollar invested, how much social output will this generate over the life of the investment relative to the best available charitable option?

Example:

1) Donation to charity to distribute bednets. $325,000 + cost of administration $65,000 = total society cost $390,000

2) Investment in firm that produces anti-malarial bednets. $325,000 + cost of administration $130,000 – return (6% annually 5 years) $422,500 = cost to society $32,500

This analysis can be further extended to social impact projections and derive at a BACO ratio. I will stop here for the moment to consider that even at the most basic level (without addition of positive externalities of local job creation on the ground if malaria nets are made instead of being distributed), society as a whole is better off with a lower investment to protect the same number of people.

Filed under: Uncategorized | Leave a Comment

Impact Investors

Summary of a brilliant article I found on the Acumen Fund Knowledge Centre (great resource, if you haven’t discovered it already):

Impact investors: seek to combine financial returns with social impact using the tolls of venture capital to make principal investments in private, high-growth companies that have the potential to deliver measurable social or environmental benefit. More patient capital that is willing to assume higher risk for lower returns.

Huh? Why? GOES AGAINST EVERY RULE OF Capitalism – higher risk and lower returns?! But wait and see, the venture capital ecosystem is evolving…

Impact investors will often, but not always be willing to exchange a lower economic return for potential social or environmental impact – here are some reasons why:

-investments are mission driven (poverty alleviation, climate change targets)

-government/international community sponsored (eg International Finance Corp IFC)

-regulatory/political frameworks (community re-development in US)

Different sources of capital determines degree of impact investing:

-financial institutions in the US compelled by community reinvestment Act

-pension funds looking to diversity their risk and fulfill social obligations (may/may not receive tax credits to generate competitive risk adjusted financial returns)

-multiple high-net worth individuals

-single limited partners (one high network individual) – higher degree of flexibility

-governments

-foundations (indirectly seed funds through program related investments (PRIs)

-individual donors (aggregated)

Many social investment funds are closed-ended limited partnerships, with offshore structures that aim to optimize taxes on investment returns for their LPs. Most funds are operating between the $50-100M capital deployed range with individual company investments ranging $500k-$2M. At the commercial end of the spectrum, investors are expecting 25-30% IRRs, while some funds are okay with real return of principal.

Fund’s investment strategy = theory of change – or why it believes world will be better place because of its investments.

Conclusion: Impact investors are here to stay. Part of a new emerging asset class that can generate deal flow, test new ideas, expand into new markets and in the process contribute to solving some of the world’s most pressing social problems – with a reasonable return by most measures.

Filed under: Uncategorized | Leave a Comment

Cost Accounting… Without Borders

This is the last week of our hospital financial improvement project here in Rwanda. In the process of editing and finishing our written report. We made our final presentation to all invited hospital staff last week already.

Our focus has been on 1) Issue of inventory supply management within a hospital (reducing stock-out situations) and 2) Issue of how to make capital expenditures (MRI machine, dialysis) more accessible to patients. Taking a few moments to reflect on the last six weeks:

- Provision of healthcare for all is a universal problem for all governments (both developed and developing nations)

- The advancements of technology and innovation does not come at zero cost

- Healthcare is a public good – moral obligation to provide the best possible service with low consideration on patients’ ability to pay

- In most countries, healthcare services do not run in the black – most hospitals are operating at a deficit and require government support to cover operating budgets

- US may serve as a model on how private hospitals can make money, but this is an extreme example and there are millions that suffer without insurance

What is also important to note is the importance of management, leadership and operational knowledge within a hospital.

- Annual budgetary planning is not a glamorous job – however, it must be done starting with the end users (frontline personnel of doctors and nurses), the procurement department who buys the supplies and the finance department ultimately paying with revenue generated from services

- Management needs to know a detailed break-down of ALL costs including cost of EACH SERVICE

- Blanket prices charged for patients may not cover all variable costs leading to operating deficits

- Deprived of basic costing knowledge, the inputs into decision-making by management is limited

- Service costing, just like budget planning, takes time and is not sexy – but it must be done!!

We helped a lot on the costing services side in our hospital project. Obstacles included missing data, limited paper trail of receipts and invoices, high staff turnover and decreased continuity of responsibilities. Sound familiar? The same challenges can be found anywhere in the world! In a resource-constrained setting, it becomes one step more challenging. Doctors without borders, engineers without borders – as countries continue on the path of “development” – how about some management help? Cost Accounting… Without Borders?

Filed under: Uncategorized | Leave a Comment

Kids of Kinigi Village

The last post was about a afternoon off from the Hospital Project – and now is time for an update about weekend activities – and this weekend was certainly a treat. We obtained permits through the Rwanda Tourism Board to go Gorilla trekking in the Virunga National Park! Admittedly I am not a outdoors-y person nor wildlife conservationist, but my team-mates excitement about this excursion brought a bubbly flutter in my stomach – and these majestic animals did not disappoint. We trekked and followed the UMBANO family of gorillas led by a Silverback (grown) male named Charles. Charles is over 100kg and leads a family of 11 including 3 wives. I swear one of the mothers looked directly at me and saw through me – sharing 97% of human genes, these animals really connect.

Gorilla trekking is situated near a Rwandan village called KINIGI. When we arrived, we decided to take a walk and soon had a following about 10-12 children. These kids had impressive English, they befriended us to practice English and walked with us for two hours telling us all about their land.

“Favourite meal: Beef (meat) and rice

Dream job: Gorilla tour guide, gorilla veterinarian

Back-up job: Doctor” – they said

They attend a school called Kabara, which unfortunately has no mailing address. They asked us for a French dictionary. Although their English is impressive, Rwanda has a history of francophone communication and without French books, it was difficult for them to learn they said. Our departing gift was a French/English book we found in the only shop in the village for them to share. These kids wanted to learn so desperately, loved school and their teachers, I only wish I could help them more. What I found really impressive is the fact they kept repeating “Education is the future” and “We must go to school to find a good job”. Resource-constrained as they are, the kids of Kinigi understand the value of education as the first rung of the ladder.

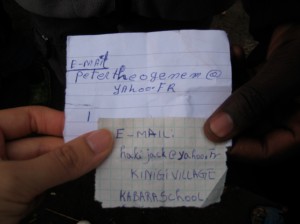

So if you are reading this post and wondering what should be your random act of kindness of today, or this week, or this year – I leave you with the email addresses of two of these kids whom I walked with for two hours. Peter (left) and Jack (right) are cousins and live in KINIGI village. They share the same grandfather, but their fathers died in the genocide. Send them an email (in English or basic French) and see what happens. Am sure they would be delighted to hear from you! Tell them you know me and then share YOUR story. The boys first learned about internet last year in school and are keen to communicate. Remember the days of having paper & pen pen-pals? Go ahead – make a new friend on the other side of the world. I dare you.

Filed under: Uncategorized | 2 Comments